In conditions where the Nota Fiscal capture monetary value transactions between the celebrations, the Nota Fiscal is likewise meant for the selection of taxes and non-use includes tax obligation cunning. Such tax-avoidance is of more significant significance as this could possibly possess a bad result on the effectiveness and earnings that these things are meant to yield. If this was the situation, the Nota Fiscal may be able to gather additional taxes and can have even more uses of tax evasion.

Nevertheless, Nota Fiscal can additionally be used in larger contexts, such as the regularization of gifts, transportation of goods, goods financings, or delivering services without economic benefit to the issuing company. The brand-new guidelines develop an existing governing framework, along with local area authorizations being made it possible for to specify the kind of financial advantage they should supply to members of their community. They will definitely currently be implemented in localized areas.

A Nota Fiscal can also call off the legitimacy of one more Nota Fiscal, such as the gain of refined products, various other terminations or termination of products and services arrangements. The Nota Fiscal might cancel the weak point of a refund through removing or making on call from the nota any kind of refundable amount to you that you had used for. This cancellation does not negate the validity of any kind of reimbursements given out under this area or for the nota Fiscal.

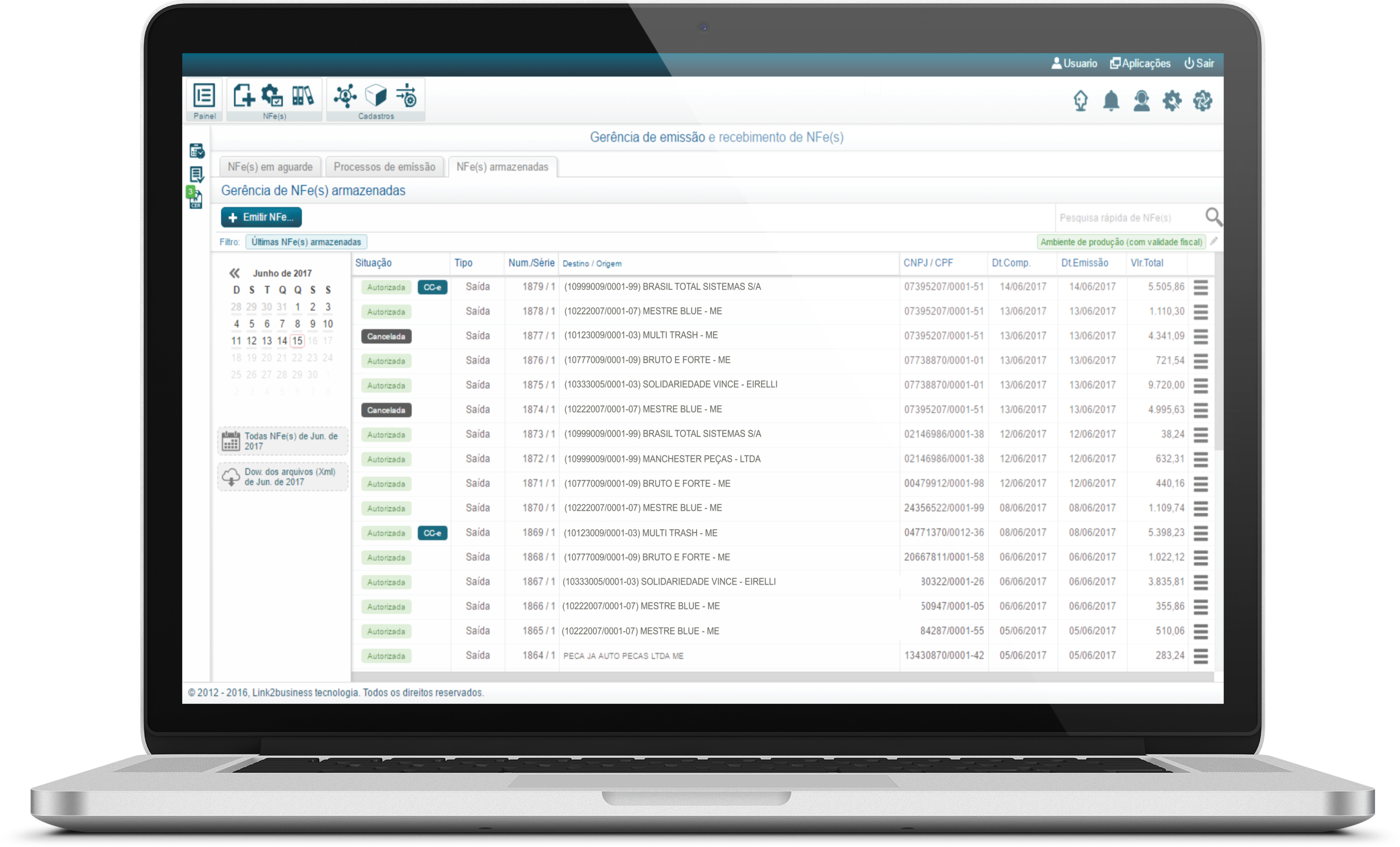

In such scenarios, the Nota Fiscal have to be given out and registered as a electronic presence documentation, given out and kept electronically in purchase to document for tax purposes (NF-e or electronic Nota Fiscal). View Details is the record of all various other records on report at or located within the Nota Fiscal which was recently enrolled or stashed at the Nota Fiscal, except records of federal government tax obligation selection. To enroll only tax obligation records in the Nota Fiscal is to enroll that details in yet another form.

The movement of goods or the regulation of solutions, which took area between the events, whose lawful credibility is ensured by the digital signature sender (guarantee of authorship and honesty) and the invoice by the Tax Administration, the electronic file is required just before the activating occasion. The government has agreed it has an incentive to provide customers the power to change their exclusive secret without the demand to expose their exclusive identity. But, to be fair, some of the very same rules apply in situations of identification burglary.

Filling Out the Nota Fiscal The Nota Fiscal features a range of obligatory areas that require to be filled up out, featuring: Type of operation and code or CFOP – CFOP ( Código Fiscal de Operações e Prestações ) is the phrase of Tax Code of Operations and Services that identify the inputs and outcomes of goods and companies interactions, intercity or interstate.

This is a numeric code that identifies the activity and attributes of the goods or the stipulation of companies, and likewise figure out tax selection and which kind of income tax must be applied. It is likewise a legitimate mathematical evidence. It is used when